STRATEGIES TO SAVE FOR RETIREMENT

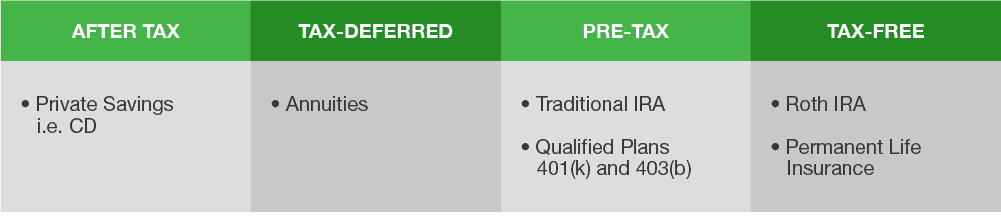

Taxes are an important part of planning your retirement strategy. You can save money before you pay taxes, or after you pay taxes. Read on to learn more about retirement savings vehicles and the types of tax strategies they use.

EXAMPLES:

Benefits of a Tax-Deferred Savings Plan:

A Tax-Deferred Savings Plan, also known as a Pre-Tax Savings Plan, allows you to use taxes for investing. Taxes which would have otherwise been paid to the government as income tax now, can be deferred until retirement; but not before using the funds that you would have otherwise paid in taxes to receive additional earnings and gains in your retirement plan. This will allow you to save more money and it will compound tax-deferred.

Employer Tax-Deferred Savings Plans:

This is a great way to save for retirement, because most people have a hard time saving, especially for their retirement. A Tax-Deferred Employer Savings Plan will fund your retirement savings plan out of your paycheck. The money is taken out of your pay check before your earnings are taxed, which means you are paying tax on a smaller amount of income and therefore you are paying less taxes while saving more money.

403(b) plans

Established in 1958, 403(b) plans are tax-deferred retirement savings plans for public school employees and tax exempt organizations. Employers direct these contributions to the available investment products selected by the employee. It’s estimated that just 30% of eligible employees participate in 403(b) plans.

457(b) plans

These are tax-deferred retirement savings plans for state/local government employees. As with 403(b) plans, employees make pre-tax contributions and select from the investment options made available by their employer. Teachers may be offered both 403(b) and 457(b) options where they can contribute to both plans. It’s estimated that only 49% of eligible employees participate in 457(b) plans..

Tax-Deferred contributions mean a lower taxable income at tax time. You’re not taxed on your income or the earnings until you withdraw it at retirement. That means your money can grow more quickly and you can save more for retirement.

Both of these plans are comparable to 401(k) plans in the private sector, where employees make pre-tax contributions. However, the participation rate is much higher in 401(k) plans. In fact, it’s estimated that 80% of eligible employees participate in 401(k) plans.

Our job at Retirement Education Partners is to help those eligible for 403(b) and 457(b) plans to take advantage of this important benefit. Our goal is to help them become as widely used as 401(k) plans.

Individual, Small Business and Self-Employed Tax-Deferred Savings Plans:

The Internal Revenue Service (IRS) allows deductions for several types of Tax-Deferred Savings Plans. One of the Tax-Deferred Savings plan options has the generic name of Individual Retirement Account (IRA). This plan can be utilized by almost everyone for retirement savings. There are also special retirement options available for individuals who are self-employed which are known as Simple and SEP IRA’s. There are differences among these options, but they do have one thing in common, they are all Tax-Deferred Savings Plans. This means you do not pay taxes on the amount contributed to your plan, nor do you pay taxes on the earnings and gains in your savings plan until you withdraw the funds in retirement.

Traditional IRAs

An IRA, or Individual Retirement Account, is where individuals make contributions to save for retirement. Today, annual contributions to IRAs cannot exceed more than $5,500, or $6,500 if you are 50 or older. Your withdrawals are taxed as income when you retire.

Simple IRAs

A Simple IRA is an employer provided retirement plan for businesses with 100 or fewer employees. They provide an employer matching incentive. The employer either matches the contributions employees make, up to 3% of their salary, or make contributions for employees at a flat-rate 2% of their salary – regardless of whether or not employees participate in the plan. This is different from 401(k) plans, where employers can choose whether to match employee contributions.

SEP IRAs

A SEP IRA, or Simplified Employee Pension is a basic retirement account for business owners and self-employed individuals. Contributions are tax-deductible, and investments grow tax-deferred. When you withdraw at retirement, the distributions are taxed as income. If you have eligible employees, you are required to make contributions on their behalf.

Benefits of a Tax-Free Savings Plan:

At retirement, you will lose many of the tax deductions you have relied on to lower your taxes such as retirement savings plan contributions, dependents, and mortgage interest. By using a tax-free retirement savings plan, you can help offset your taxes in retirement.

ROTH IRA

With a Roth IRA Savings Plan, your after-tax dollars go into your Roth Savings Plan and grow on a tax-free basis, and then you don’t pay any taxes on withdrawals as long as you satisfy qualifying conditions with the IRS. To contribute to a ROTH IRA, your adjusted gross income must be below a certain threshold. In 2018, contributions are limited to $5,500 per person. If you’re age 50 or older, you can contribute an extra $1,000 as a catch-up provision.

Indexed Universal Life (IUL)

Using an Indexed Universal Life (IUL), is one of the best tax-free retirement savings plans available, especially if your gross income exceeds the threshold limits of the ROTH IRA plan. The Indexed Universal Life shares some of the main characteristics of a ROTH but without gross income contribution limits. Not only does the Indexed Universal Life provide the same tax-free savings advantages for retirement but it will also provide a death benefit to protect your loved ones and it will provide Living Benefits.

GIVE US A CALL

214-295-2788

OUR HOURS

Monday-Friday

8AM – 5PM

E-MAIL US

VISIT OUR OFFICE

516 South Wheeler St.

Jasper, TX – 75951